Corporate taxpayers doing business in California often share the sentiment that tax compliance and planning in the state can be as cumbersome and complex as federal efforts. Tax depreciation is one such area where California state rules differ significantly from the federal rules.

California does not conform to either the Accelerated Cost Recovery System (ACRS) or Modified Accelerated Cost Recovery System (MACRS) systems of depreciation for corporate tax purposes. California conforms only to the depreciation methods specified in IRC §167, prior to the enactment of the ACRS and MACRS systems. Therefore, it is imperative that corporate taxpayers review their depreciation methods to ensure that they comply with the methods prescribed in California Revenue and Taxation Code (RT&C) Sections 24349 through 24354 (to access all primary sources, log in or request a demo).

The only acceptable methods of depreciation for California tax purposes are:

When assigning a useful life for California depreciation purposes, it is important to note that the state adheres to the federal Class Life Asset Depreciation Range (ADR) System provisions. Taxpayers can find the applicable useful lives in IRS Rev. Proc. 87-56 (to access all primary sources, log in or request a demo).

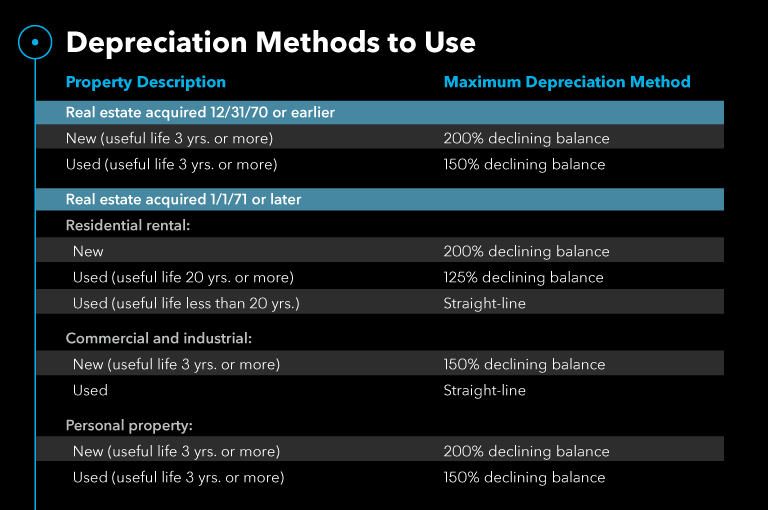

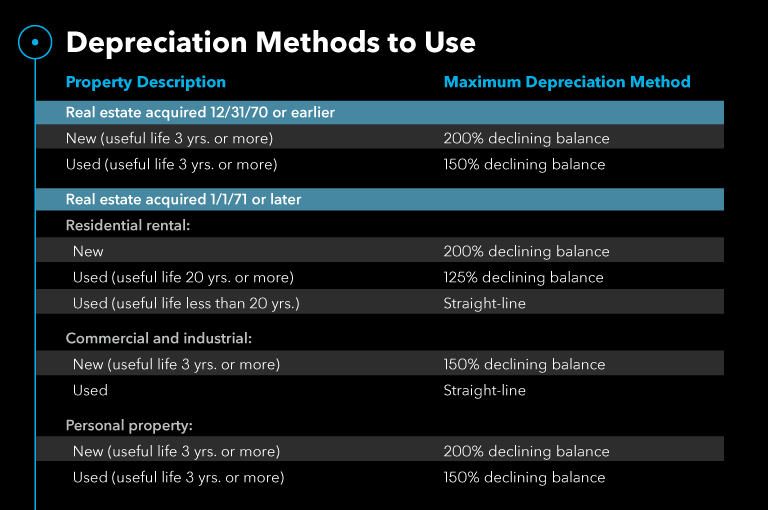

Corporate taxpayers often default to the straight-line method for depreciating their assets for California purposes. However, taxpayers should refer to the instructions for Form FTB 3885 for state recommended depreciation methods and useful lives for various property types depending on the nature of the property, whether the property is new or used, and the acquisition date of the property. A review of the form instructions could possibly lead to more favorable state tax depreciation deductions.

In addition to differing depreciation methods and useful lives, California taxpayers should be aware of other areas of federal nonconformity: