Tennessee passed new legislation in June 2020 which made some pretty serious changes to the state’s construction payment laws, affecting rules for notices, retainage, and prompt payment. Perhaps most importantly, the state changed the Notice to Owner rules quite a bit.

SB 2681 (and its counterpart HB 2706) moved through the Tennessee legislature in a hurry. After being deferred back in March, the bill was placed on the calendar on June 3, 2020 and was signed into law on June 22, 2020. It came into effect on July 1, 2020 — only 9 days later.

Let’s look at a few different areas where notable changes occurred. In addition to the larger changes highlighted below, there were lots of clarifications and alterations to language that may end up being impactful.

Table of Contents

As of July 1st 2020, the only parties who must send a Tennessee Notice to Owner are prime contractors hired directly by the owner on an owner-occupied, residential project. This includes projects of 1-4 units, and it also includes properties that the owner intends to reside in after construction. So, new builds will be subject to these Notice to Owner rules unless the owner of the property won’t live there (like on some development projects).

Additionally, the legislature relaxed the actual text of that notice, too. The text of the Notice to Owner form has always been bound by the statute that governs Tennessee mechanics liens, but now the notice is shorter and easier to understand.

Here’s the new language that must appear in a Tennessee Notice to Owner:

The above-captioned contractor hereby gives notice to the owner of the property to be improved, that the contractor is about to begin improving the property according to the terms and conditions of the contract and that under the provisions of the state law (§§ 66-11-101 — 66-11-141) there shall be a lien upon the real property and building for the improvements made in favor of the above-mentioned contractor who does the work or furnishes the materials for such improvements for a duration of one (1) year after the work is finished or materials furnished.

We updated our free form to reflect Tennessee’s statutory changes effective July 1, 2020.

SB 2681 turns the old notice rules on their head. Previously, prime contractors were exempt from sending a Notice to Owner when they were working on owner-occupied, residential jobs of up to 4 units. Now, that’s the exact situation which requires the notice.

Further, the text of the prior notice was awfully formal, in multiple sections with hard to read language. As you can see above, the new notice lingo is much more user-friendly.

The changes to Tennessee’s retainage rules weren’t quite as dramatic.

The legislature added Section 66-34-103(e)(4) to exempt public entities from the offenses and penalties associated with late retainage in Tennessee.

For others, failure to release retainage on time can result in fines of $3,000 per violation, plus it’s a misdemeanor. These fines will not be applied to public entities.

The legislature altered Section 66-34-104, which changes some terminology i n Tennessee’s retainage penalties.

Previously, the consequence for failing to put retaina ge funds into escrow was called a “penalty.” Now, the legislature has made clear that this shouldn’t be construed as a penalty, but rather, as “damages.” The new statute also clarifies that the damages accrue from the first date when funds were withheld up to the date when they’re put into an interest-bearing escrow account.

There were also several changes under the Tennessee prompt pay act, which sets rules for the timing of construction payments. Let’s look at these changes separately.

Under SB 2681, a party going bankrupt or becoming insolvent isn’t a defense for an owner’s or other third party’s failure to release trust fund payments that are otherwise due. That’s good news – it means that someone saying they can’t afford to pay you on time isn’t a valid defense. Plus, even if they end up filing bankruptcy, your interests are protected.

Interest penalties for late construction payments has increased under Tennessee’s prompt pay rules. They have also become much more clear.

First, the construction contract will set the interest rate, so it’s important to take care when drafting and negotiating your agreement.

For situations where the contract doesn’t specify an interest rate, Tennessee’s interest rate penalty will be a simple 1.5% per month.

That’s quite a dramatic increase in the penalty for late construction payments in Tennessee. Previously, interest was calculated at 2% less than the “formula rate per annum.” The previous rate would have worked out to just .44% on a per-month basis.

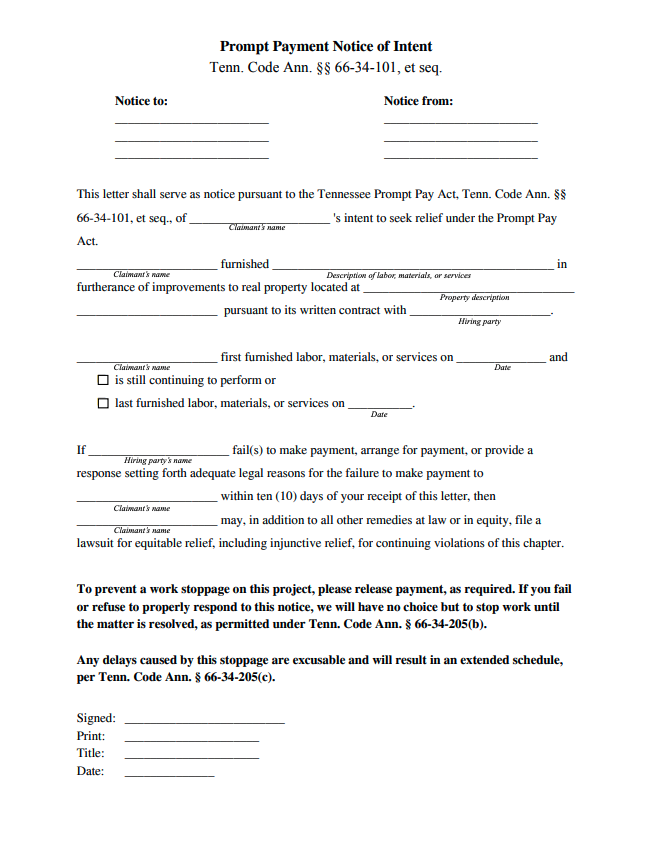

If a contractor, sub, supplier, etc. is going to look for relief under the Tennessee prompt payment laws, they must first give a notice of intent. It’s a lot like a Notice of Intent to Lien, but instead of notifying about the potential for a lien claim, it’s a notice that the prompt payment laws may soon be invoked.

That isn’t a new provision. However, under these new amendments, there’s a statutory form for the notice. Plus, an unpaid contractor can include it directly with a Notice of Nonpayment (monthly notice). The required text is below.

This letter shall serve as notice pursuant to the Tennessee Prompt Pay Act, Tenn. Code Ann. §§ 66-34-101, et seq., of [prime contractor or remote contractor]’s intent to seek relief under the Prompt Pay Act.

[Prime contractor or remote contractor] furnished [description of labor, materials, or services furnished] in furtherance of improvements to real property located at [property description] pursuant to its written contract with [lender, owner, prime contractor, or remote contractor].

[Prime contractor or remote contractor] first furnished labor, materials, or services on [insert first date] and [“is still continuing to perform” or “last furnished labor, materials, or services on (insert date)”]. If [owner, prime contractor, and/or remote contractor] fail(s) to make payment, arrange for payment, or provide a response setting forth adequate legal reasons for the failure to make payment to [prime contractor or remote contractor] within ten (10) days of your receipt of this letter, then [prime contractor or remote contractor] may, in addition to all other remedies at law or in equity, file a lawsuit for equitable relief, including injunctive relief, for continuing violations of this chapter.

Download a free Prompt Payment Notice of Intent form, prepared by construction attorneys to meet the statutory requirements in Tennessee.

The right to stop work is new in Tennessee’s construction rules. If an unpaid party sends the above Notice of Intent, then the recipient must either make payment or provide adequate legal reasons for the failure to make payment. Otherwise, the law entitles the party who sent the Notice of Intent to stop work. Of course, this will only be available as long as the sender wasn’t in breach of their contract.

Importantly: If work is stopped, then the party who stopped work must be granted an extension of their contract schedule.

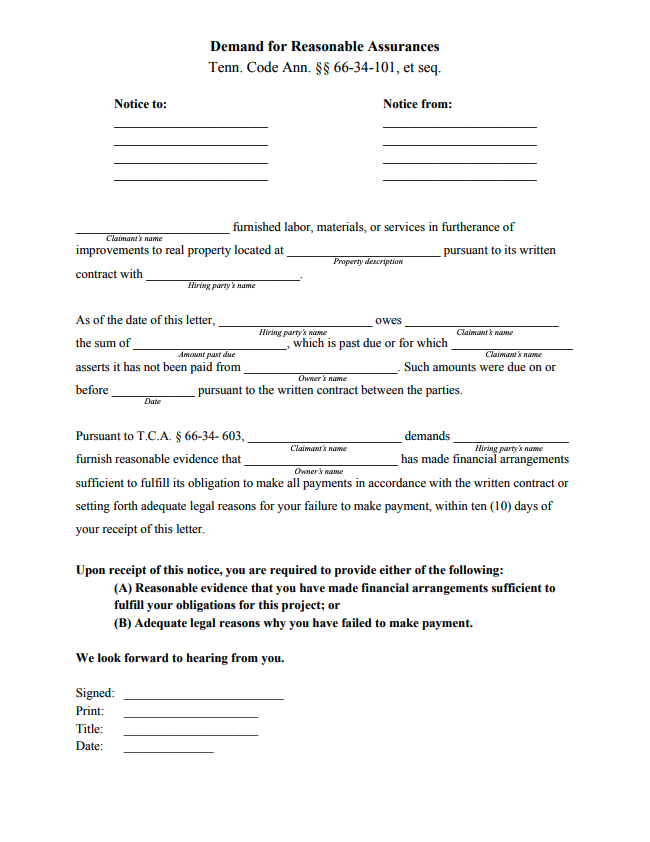

This is a totally new section, and it only applies to private property owners in Tennessee.

The first part is simple: The law entitles the prime contractor to request financial info from the owner, prior to the start of work. Specifically, the owner must furnish reasonable evidence the owner has secured a loan or has otherwise made financial arrangements sufficient to make all payments on the contract. Upon request, the owner must provide this information within 10 days.

If the owner falls behind on payments at some point, a prime contractor can send a “Demand for Reasonable Assurances” to request that the owner provide reasonable evidence that they will be able to make all payments in accordance with the prime contract.

The owner must provide either (a) reasonable evidence they’ll be able to fulfill their obligations; or (b) adequate legal reasons for their failure to make payment. The Demand for Reasonable Assurances can be sent by itself or in conjunction with other notices – like the Notice of NonPayment.

Here’s the statutory form provided for that demand:

[Prime contractor or remote contractor] furnished labor, materials, or services in furtherance of improvements to real property located at [property description] pursuant to its written contract with [owner, prime contractor, or remote contractor].

As of the date of this letter, [owner, prime contractor, or remote contractor] owes [prime contractor or remote contractor] the sum of [amount past due], which is past due or for which [prime contractor or remote contractor] asserts it has not been paid from [owner]. Such amounts were due on or before [insert due date] pursuant to the written contract between the parties.

Pursuant to T.C.A. § 66-34- 603, [prime contractor or remote contractor] demands [owner] furnish reasonable evidence that [owner] has made financial arrangements sufficient to fulfill its obligation to make all payments in accordance with the written contract or setting forth adequate legal reasons for your failure to make payment, within ten (10) days of your receipt of this letter.

Download a free Demand for Reasonable Assurances form, prepared by construction attorneys to meet Tennessee’s statutory requirements.

These changes are effective now. They came into effect on July 1, 2020 – only 9 days after the governor signed SB 2681 into law. According to Section 42 of the Act, it “applies to actions occurring and contracts entered into, amended, or renewed on or after” July 1st.

Generally, that means it should really only be a concern for jobs that begin after July 1st. However, if parties amend or renew a contract after July 1, then the new rules will be applicable. Considering courts generally consider change orders to be amendments to the contract, and considering how common change orders are in construction, these provisions could come into play sooner than you think. For the most part, that should be a positive thing.

Recent questions other contractors have asked aboutI sent the pre-construction notice for Arkansas today 06/19/2023. Will I still be able to file a lien.

In the state of Missouri, what happens to a general contractor's mechanics lien rights if the property is quit claimed from the original owner to a new owner? Additionally, what happens to a general contractor's mechanics lien rights if the property undergoes a trustees sale/foreclosure to a new.

I never signed a contract with my contractor. All work has been hourly plus materials costs. He has only provided email invoices. Is he obligated to provide paper copies of the invoices?