Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first module of each course. Start Free

While the general structure of financial statements for banks isn’t that much different from a regular company, the nature of banking operations means that there are significant differences in the sub-classification of accounts. Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets (loans) and their cost of funds (customer deposits).

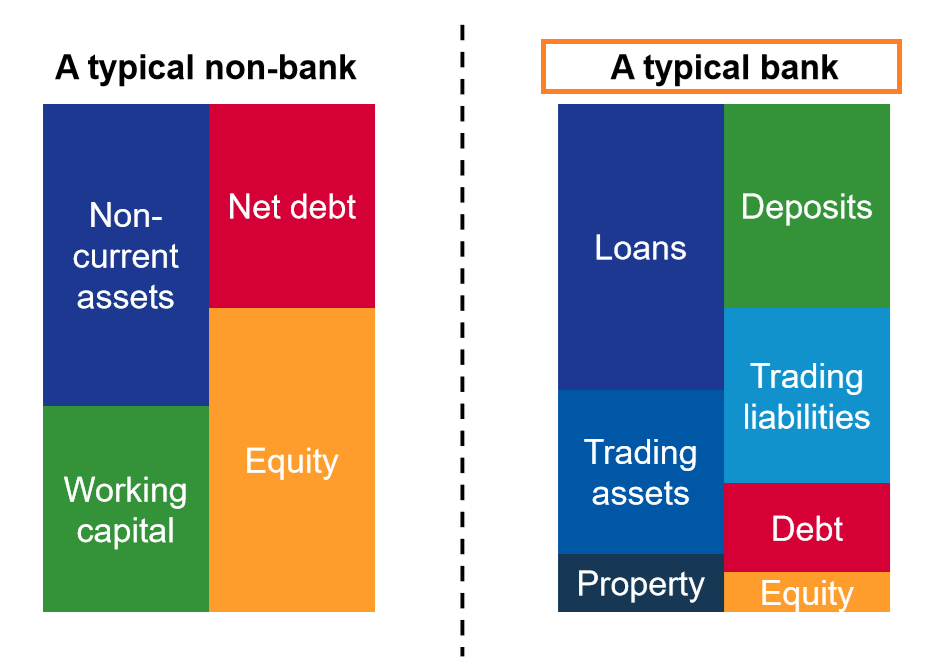

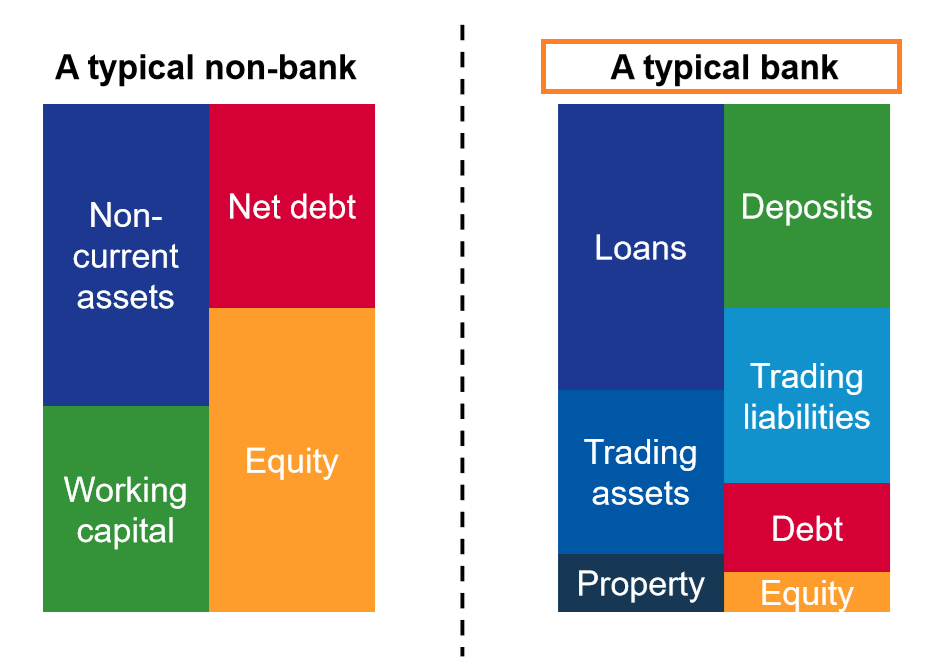

A typical balance sheet consists of the core accounting equation, assets equal liabilities plus equity. Under these accounts, non-banking companies may have other large classes such as PP&E, intangible assets, current assets, accounts receivables, accounts payables, and such.

A bank, however, has unique classes of balance sheet line items that other companies won’t. The typical structure of a balance sheet for a bank is:

Recall from CFI’s Balance Sheet Guide that ASSETS = LIABILITIES + EQUITY.

A bank’s balance sheet has certain unique items. We visit each unique line item in the subsections below.

The main operations and source of revenue for banks are their loan and deposit operations. Customers deposit money at the bank for which they receive a relatively small amount of interest. The bank then lends funds out at a much higher rate, profiting from the difference in interest rates.

As such, loans to customers are classified as assets. This is because the bank expects to receive interest and principal repayments for loans in the future and thus generate economic benefit from the loans.

Deposits, on the other hand, are expected to be withdrawn by customers or also pay out interest payments, generating an economic outflow in the future. Deposits from customers are, thus, classified as liabilities.

In the questions of financial statements for banks, where do these banks store their money? It’s like the age-old question: do barbers cut their own hair?

Most countries have a central bank, where most (or all) national banks will store their money and profits. Deposits from a bank in a central bank are considered assets, similar to cash and equivalents for a regular company. This is because the bank can withdraw these deposits rather easily. It also expects to receive a small interest payment, using the central bank’s prime rate.

Loans from the central bank are considered liabilities, much like normal debt.

Banks may hold marketable securities or certain currencies for the purposes of trading. These will naturally be considered trading assets. They may have trading liabilities, which consists of derivative liabilities and short positions.

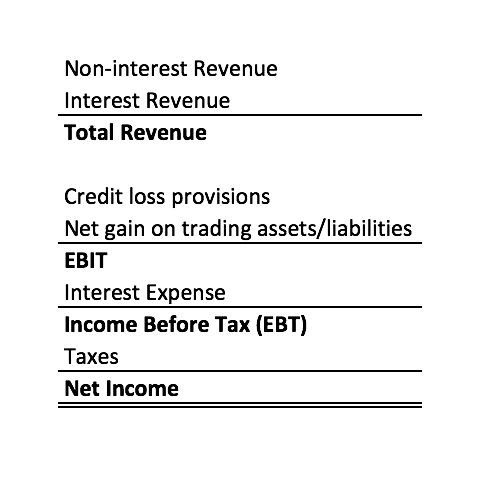

Again, the overall structure of an income statement for a bank doesn’t stray too far from a regular income statement. The top of the income statement is revenue and the bottom is net income.

However, revenue is derived differently from that of regular companies. The income statement will generally look as follows:

Again, let’s walk through the unique line items not found in common income statements.

Non-interest revenues consist of ancillary revenue the bank makes in supporting its services. This can consist of:

These revenues come from anything that does not constitute interest revenue.

Interest revenue captures the interest payments the bank receives on the loans it issues. Sometimes, this line item will only state gross interest revenue. Other times, this line will consolidate gross interest revenue and deduct interest expense to find net interest revenue. This interest expense is the direct interest expense paid to the deposits used to fund the loans, and does not include interest expense from general debt.

Just like accounts receivables and bad debt expense, a company must prepare in the event that borrowers are not able to pay off their loans. These bad pieces of credit are written off in the income statement as a provision for credit loss.

Thank you for reading CFI’s guide to financial statements for banks. To advance your career, these additional CFI resources will be helpful:

Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst.